Medicare Graham - An Overview

Medicare Graham - An Overview

Blog Article

Medicare Graham Things To Know Before You Get This

Table of ContentsHow Medicare Graham can Save You Time, Stress, and Money.8 Easy Facts About Medicare Graham ExplainedA Biased View of Medicare GrahamIndicators on Medicare Graham You Need To KnowThe Best Strategy To Use For Medicare Graham

Before we speak regarding what to ask, allow's speak regarding who to ask. For several, their Medicare trip starts directly with , the main web site run by The Centers for Medicare and Medicaid Solutions.

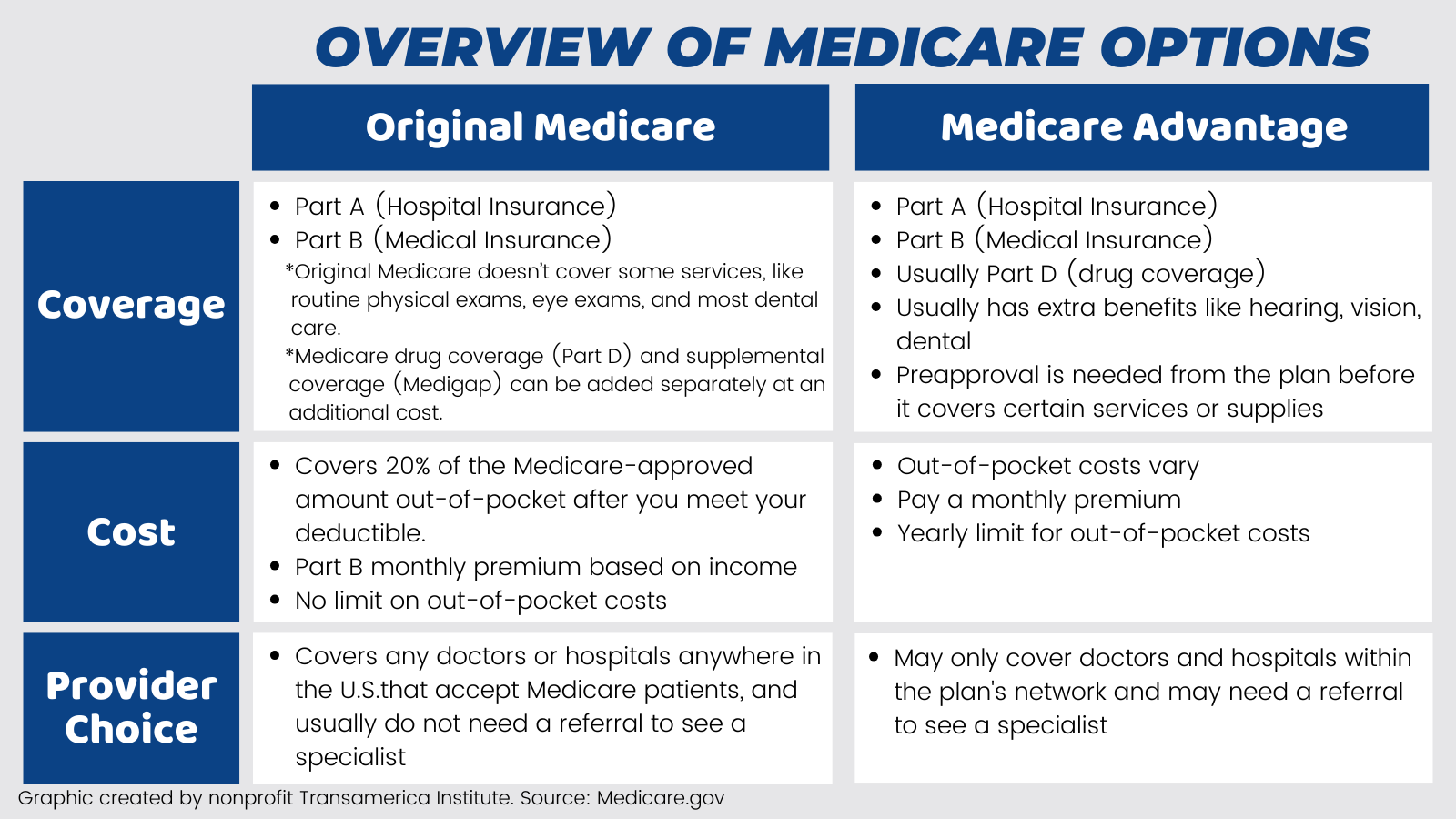

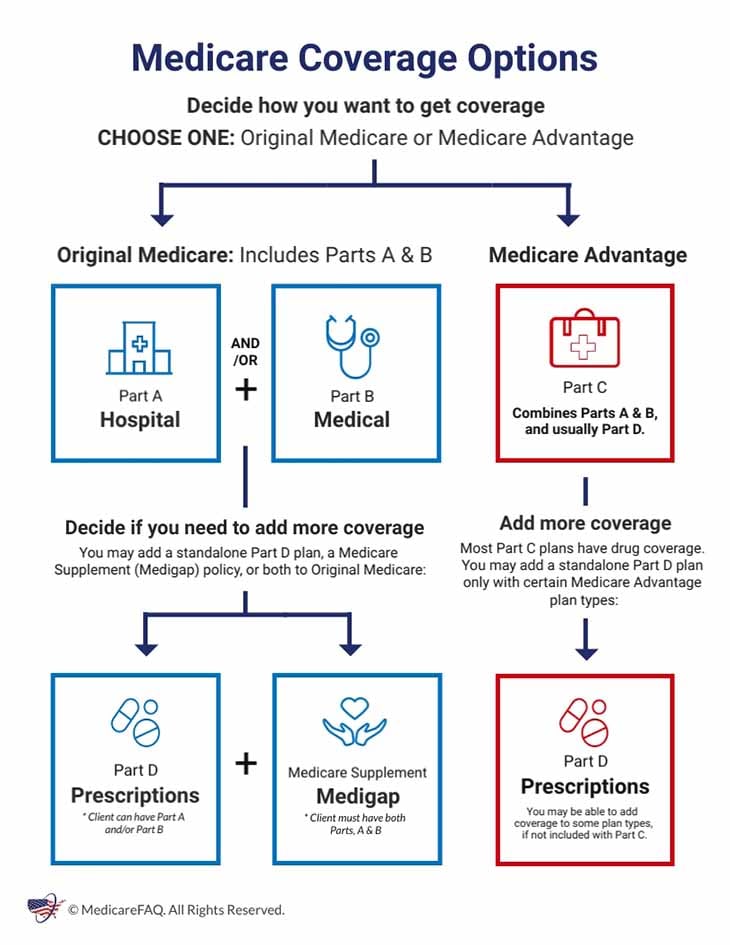

It covers Part A (medical facility insurance policy) and Part B (medical insurance policy). This consists of points that are considered clinically needed, such as medical facility remains, regular physician visits, outpatient solutions and even more. is Medicare coverage that can be bought straight from a private health and wellness treatment firm. These strategies work as an alternative to Original Medicare while providing more benefits - Medicare West Palm Beach.

Medicare Component D plans help cover the cost of the prescription medications you take in the house, like your everyday medicines. You can register in a different Part D strategy to add medication insurance coverage to Original Medicare, a Medicare Price plan or a couple of various other types of plans. For numerous, this is usually the first question thought about when looking for a Medicare plan.

The 7-Second Trick For Medicare Graham

To obtain the most cost-efficient wellness treatment, you'll desire all the solutions you make use of to be covered by your Medicare strategy. Your plan pays whatever.

, as well as coverage while you're traveling domestically. If you intend on traveling, make certain to ask your Medicare consultant regarding what is and isn't covered. Maybe you've been with your existing doctor for a while, and you want to maintain seeing them.

See This Report on Medicare Graham

Numerous people who make the switch to Medicare proceed seeing their routine physician, but also for some, it's not that straightforward. If you're dealing with a Medicare expert, you can ask them if your physician will be in connect with your new plan. Yet if you're looking at plans independently, you may have to click some links and make some phone calls.

For Medicare Benefit strategies and Expense plans, you can call the insurance business to make certain the physicians you want to see are covered by the strategy you want. You can additionally check the strategy's site to see if they have an online search tool to locate a protected physician or facility.

Which Medicare strategy should you go with? That's the very best part you have alternatives. And inevitably, the option is up to you. Keep in mind, when obtaining started, it is necessary to ensure you're as notified as possible. Beginning with a list of factors to consider, see to it you're asking the appropriate concerns and begin concentrating on what kind of strategy will best offer you and your demands.

Medicare Graham Things To Know Before You Buy

Are you regarding to turn 65 and end up being recently eligible for Medicare? The least pricey strategy is not necessarily the ideal option, and neither is the most costly plan.

Also if you are 65 and still working, it's a good concept to examine your options. People obtaining Social Safety and security advantages when turning 65 will certainly be immediately registered in Medicare Components A and B. Based on your work scenario and healthcare choices, you might require to take into consideration enlisting in Medicare.

Initial Medicare has 2 components: Part A covers a hospital stay and Part B covers clinical expenditures.

3 Simple Techniques For Medicare Graham

There is normally a costs for Component C plans on top of the Component B premium, although some Medicare Benefit intends offer zero-premium plans. Medicare South Florida. Testimonial the protection information, prices, and any fringe benefits used by each plan you're considering. If you sign up in initial Medicare (Parts A and B), your premiums and protection will certainly be the very same as other individuals who have Medicare

(https://www.metooo.io/u/m3dc4regrham)This is the most a Medicare Benefit participant will certainly have to pay out-of-pocket for protected services each year. The amount differs by strategy, yet when you get to that limit, you'll pay nothing for covered Component A and Component B solutions for the remainder of the Look At This year.

Report this page